Starting a new paid marketing campaign is no easy feat.

There are logistical considerations, financial considerations, audience considerations, duration considerations.

Let’s imagine you’ve decided to start a new Google Ads campaign. You have a vague idea how much everything will cost, and you’re eager to get started.

Before you hit the green light on your new campaign, you need to know about your future profitability, particularly when your profits will break even with your costs.

Why does that matter?

At that point in your campaign’s lifespan, you’re primed to start turning a profit rather than existing in the red.

How do you determine that point?

By conducting a breakeven analysis.

What Is a Breakeven Analysis?

Whether you’re running a PPC campaign, adding a new advertising stream to your ongoing strategy, setting up an e-commerce store, or even opening a brick-and-mortar store, you need to conduct a breakeven analysis.

As we mentioned above, it lets you know when you can anticipate your endeavor to start paying off.

Beyond that, this analysis lets you know if your endeavor is viable or if it will be impossible to achieve financial success given your business model.

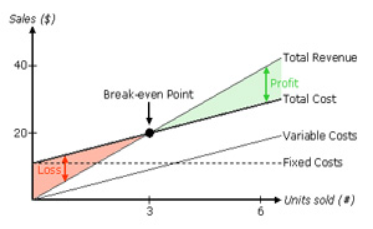

By helping you determine fixed costs (expenses like rent) and variable costs (like materials), you can set prices that reflect these expenses and predict when your business will move into the liminal space between expense and profit.

This stage of in-between profit and expense is referred to as the breakeven point (BEP), the stage when revenues equal costs. Once you’ve identified your BEP, assess all your costs from rent to labor to pricing structure to ensure you’re not spending any unnecessary money.

First, determine if your costs are too high or your prices too low to reach your BEP in a manageable timeframe.

Next, decide if your plan will be sustainable.

Not only does your BEP alert you to a specific event that should signal your move out of the red, but it also lets you know if you need to adjust your business spend.

Why You Should Do a Breakeven Analysis

The breakeven analysis is a hallmark of every good business plan. It allows you to determine cost structures and if you should move forward.

While it may seem like a breakeven analysis can only be completed before starting your business, this process can be helpful well beyond business launch.

By assessing and reassessing your business’ cost structures, you can forecast several different outcomes regardless of where you are in your company’s lifespan.

Benefits to conducting this type of analysis include:

- correct pricing of product or service

- view of profitability

- provides information to adjust strategies for progressing

When Should You Complete a breakeven Analysis?

A breakeven analysis can be conducted at any time. However, there are four distinct actions that should trigger this analysis at your business:

New Business

As we mentioned above, conducting a breakeven analysis for a new business is vital for determining viability and pricing structure.

New Product

If you’re adding a costly new product to your business, you must calculate your BEP to ensure the potential gain is worth the cost.

New Sales Channel

Costs change whenever you incorporate a new sales channel. Whether those costs are contingent on the channel itself or the associated marketing expenses, be sure to conduct a breakeven analysis every time you add a new sales channel.

New Business Model

When you switch to a new business model, your costs can change drastically. To make sure the new model is sustainable, conduct a breakeven analysis.

2 Steps to Run a Breakeven Analysis

Hopefully, we’ve conveyed the value of this type of analysis, regardless of where you are in your campaign or business journey.

Below, we break down the steps to run an analysis.

Aggregate Data

Identify all the expenditures you foresee for your business and divide those costs into two categories: fixed and variable.

- Fixed costs: These expenditures refer to any expenses that stay the same, regardless of your business’ success or failure. Categories include rent, labor (if full-time/set), and software subscriptions.

- Variable costs: These costs refer to any expenditures that are contingent upon how much you sell. Consider materials, payment processing, labor (if part-time/fluid).

After you’ve identified all of these costs, decide on an average amount for each expenditure. These aren’t set in stone, but they should be within the realm of possibility for each commodity.

Compute

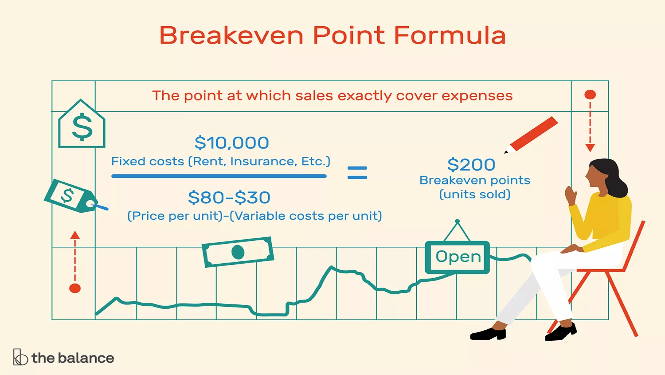

The formula for breakeven analysis is a two-step process.

- Calculate how many breakeven units are necessary using this formula: fixed costs divided by (revenue per unit minus variable costs per unit).

- Determine your breakeven sales volume by using unit sales price times breakeven units.

This final breakeven sales volume point allows you to determine if your business is sustainable if your goals are reasonable, and how to adjust your pricing and spend accordingly.

How to Track a Breakeven Analysis

While your breakeven point isn’t the final word in the ultimate success of your venture, it’s still a milestone indicative of your business’ growth.

As you launch your campaign, store, or product, keep an eye on your breakeven analysis and adjust as revenue rolls in or unforeseen expenses occur.

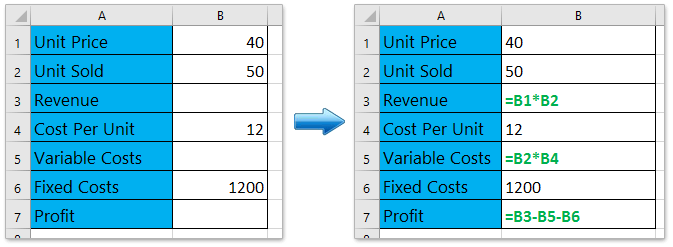

To keep your analysis up-to-date, you could use Microsoft Excel to crunch the numbers for you.

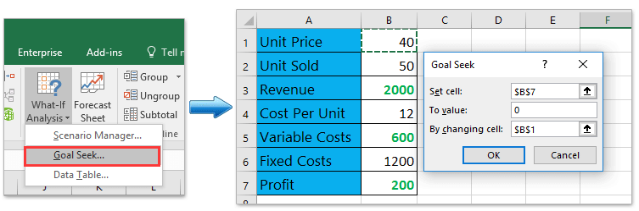

Use Excel’s Goal Seek, a tool that allows users to define by either unit or price.

The Goal Seek function allows users to break out specific amounts and conduct auditable adjustments.

To complete this function, follow these five steps:

- Enter the terms seen in the image below step two in column A of your spreadsheet.

- Key in the below formulas to calculate revenue, variable cost, and profit

- Revenue = Unit Price x Unit Sold

- Variable Costs = Cost per Unit x Unit Sold

- Profit = Revenue – Variable Cost – Fixed Costs

- Select Data > What-If Analysis > Goal Seek.

- In the open Goal Seek dialog box, please complete the four below actions:

- Specify the “Set Cell” as the Profit cell (B7 in this example).

- Specify the “To value” as 0.

- Specify the “By changing cell” as the Unit Price cell (B1 in this example).

- Select OK.

Using Excel’s Goal Seek functionality, you can plug and play different scenarios as they arise. This tool also allows users to forecast what-ifs, enabling planning for eventualities that may or may not occur.

Through experimentation, you can help prepare your campaign, business, or product for any eventuality.

What to Do If Your Breakeven Analysis Was Wrong

While a breakeven analysis can be highly beneficial for assessing the sustainability of your campaign or project, the formula is not without its limitations.

Unanticipated external factors can wreak havoc on your formula, resulting in incorrect projections and measurements.

These factors can include:

- lack of demand

- incorrect data

- lack of nuance in the formula

- time fluctuations

- competitors

These five factors can dramatically impact your breakeven analysis.

In addition to these external forces, what if the result of the breakeven formula is unattainable for your budget?

Should you ditch that new advertising channel altogether or give up on your dreams of a brick-and-mortar store?

The answer is no.

Below, we break down three strategies to enact if your breakeven analysis shows unsustainability for your next venture.

Reduce Fixed Costs

Is there an opportunity to reduce your fixed costs? Take it. The lower your fixed costs can go, the fewer units you need to sell to reach your breakeven point.

Increase Your Prices

When you increase your prices, you reduce the number of units you need to sell to break even. A general caveat is to be mindful of the expectations that come with an increased price and what the market will realistically pay. The more you charge, the better product or service your consumers expect.

Reduce Variable Costs

Reducing variable costs can be challenging, but the more you can scale, the more you can lower variable costs. Regardless of what industry you’re in, consider changing your processes, negotiating with your suppliers, or changing materials.

Conclusion

Regardless of whether you’ve decided to start advertising on Instagram for the first time or are opening the doors to a brick-and-mortar store, the accuracy of a breakeven analysis is complicated.

To ensure you get as close as possible to the correct figure, be sure to get into granular detail on the costs and prices that correlate with your business.

In addition to possessing a thorough understanding of the costs associated with delivering your message or product to consumers, you must know the right price to charge for your product. Miscellaneous expenses add up; consider all possible variable and set costs.

To ensure you’re identifying the right price points for these items, analyze every product, service, or resource your business uses, produces, sells, or plans to sell. By organizing these items by profitability priority, you can further reduce costs and potentially reach your BEP sooner.

As you near the breakeven point, be sure to continuously monitor your performance through other metrics—breakeven analysis is just a tool in many that can help your business succeed.

What’s your best practice for identifying all variable and fixed expenses?

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

- SEO – unlock massive amounts of SEO traffic. See real results.

- Content Marketing – our team creates epic content that will get shared, get links, and attract traffic.

- Paid Media – effective paid strategies with clear ROI.